Short Term Loans: What They Are, Who Uses Them, and What You Need to Know

When money runs out before pay day, short term loans, small, fast cash advances meant to be paid back within weeks or months. Also known as payday loans, they’re designed for emergencies—not lifestyle spending. These aren’t long-term solutions. They’re stopgaps. People use them to cover car repairs, medical bills, or rent when the bank account is empty and the next paycheck is days away.

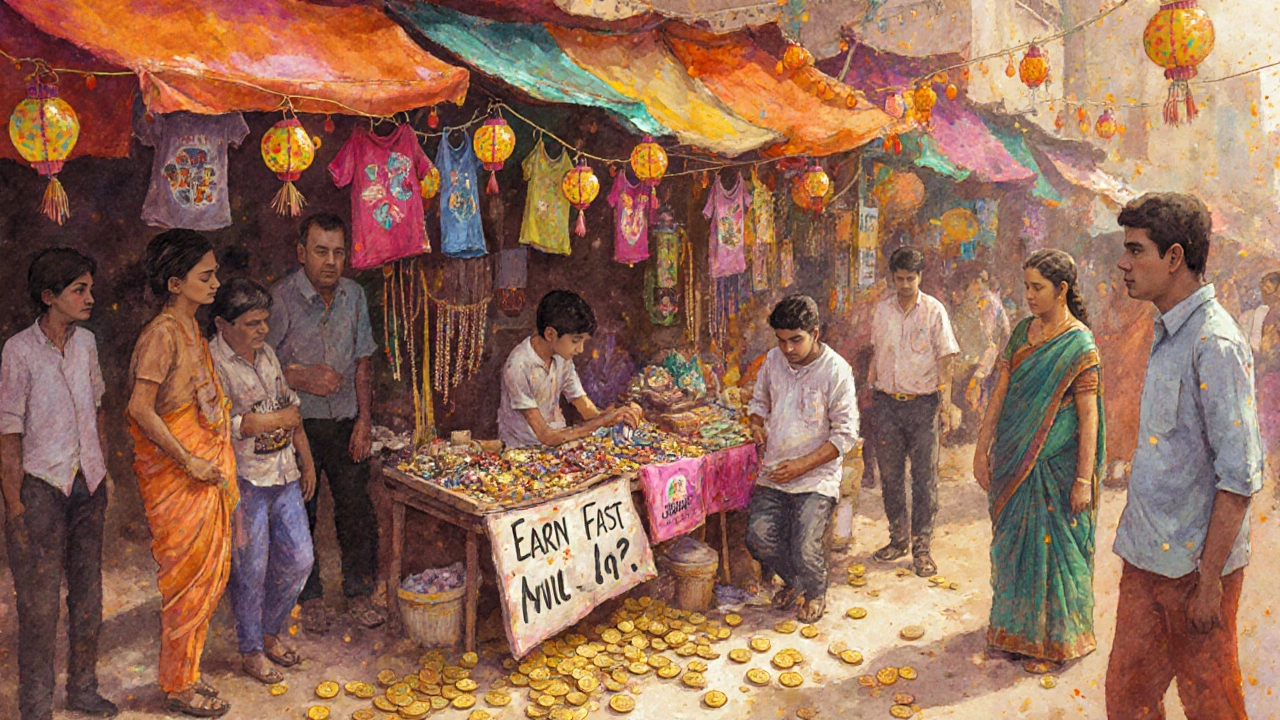

But here’s the catch: emergency loans, a common type of short term loan offered by non-bank lenders often come with fees that turn $200 into $300 in a month. That’s why so many people end up trapped, taking out new loans just to pay off the old ones. It’s not the loan itself that’s the problem—it’s the cycle. quick cash, the promise of instant funds without credit checks sounds like a lifeline, but without a clear exit plan, it becomes a trap. And while some lenders claim they’re helping, the real help comes from knowing your options before you sign anything.

People in low-income neighborhoods, gig workers, and those without savings are the ones most likely to turn to these loans. But they’re not alone. Even people with steady jobs use them after an unexpected bill hits. The truth? short term loans aren’t the enemy. Poor planning, lack of alternatives, and predatory lending practices are. That’s why you’ll find real stories here—people who used these loans, what went right, what went wrong, and how they got out. You’ll also see what actually works better: community aid programs, food banks, local grants, and even peer-to-peer support networks that don’t charge interest.

These aren’t just financial tools—they’re survival tools. And like any tool, they’re only as good as the person using them. The posts below show real cases: someone in Arkansas who used a homeless grant instead of a payday loan, a family in New Zealand who stretched their last dollar with food banks, and others who found help through community outreach before the bank account hit zero. You’ll learn who qualifies for real assistance, how to avoid the traps, and where to turn when you need help fast—without losing your future.

Fast Ways to Raise $600 Quickly

A step‑by‑step guide showing how to raise $600 fast using sales, gig work, low‑cost loans, and community assistance while avoiding costly traps.

Detail